Inheritance Tax Overhaul UK :

The previous suggested £1million 100% IT threshold is perhaps too rigid and is not popular with any voters I’ve spoken to, or in any polls conducted. We should not wish to punish any self-made millionaire’s who’ve worked hard to get where they are, our changes to the present system should be aimed at targeting the super-rich 1% power elite.

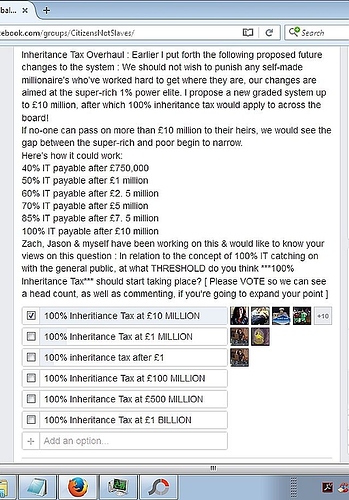

I propose a new graded system up to £10 million, after which 100% inheritance tax would apply to across the board. If no-one can pass on more than £10 million to their heirs, we would see the gap between the super-rich and poor begin to narrow.

Here’s how it could work:

I suggest a RAISE in the Free allowance to £750,000

[ That’s a £250,000 INCREASE in the threshold proposed by the Tories by 2020/1 in the rate of Inheritance Tax at 40% ]

The Proposed New Meritocratic System would look like this :

40% IT payable after £750,000

50% IT payable after £1 million

60% IT payable after £2. 5 million

70% IT payable after £5 million

85% IT payable after £7. 5 million

100% IT payable after £10 million

In my opinion, this graded system would be much more acceptable to the voting public and could even pull some middle-class, semi-retired voters who have some empathy with the less-well-off, on-board.

This idea could also be adopted by meritocracy parties in any country and adapted to suit either the currency or political climate of the day.

A level playing field between ‘ultra-rich’ and ‘below-the-poverty-line poor’ won’t come overnight, but this graded system on IT could kick-start the process of narrowing the gap.

Current UK Prime Minister Theresa May talks about a ‘Shared Society,’ though like most Tory policies, it’s mainly image and little substance. She has even mentioned the word ‘meritocracy’ in a recent speech on Jan 9th, 2017:

"It’s why as part of building a great meritocracy I have already outlined plans to increase the number of good school places so that every child – not just those who are fortunate to have parents who can afford to move to a good catchment area or pay to go private – can enjoy a school place that caters to their individual interests, abilities and needs.

So with all these steps we will deliver this new agenda of social reform. And government will step up to support and – where necessary – enforce the responsibilities we have to each other as citizens, so that we respect the bonds and obligations that make our society work.

This means government supporting free markets as the basis for our prosperity, but stepping in to repair them when they aren’t working as they should."

~ Theresa May 09-01-17

Theresa May Speech Jan 9th 2017

However, just like one of her predecessors Margaret Thatcher, who also liked to throw the word around, she has little idea of what it truly means. Ours is the real ‘meritocracy’ and this ‘IT Overhaul’ could be part of the proof of the pudding; in practical, realistic and easily understood terms.

Feedback welcome.